massachusetts commercial real estate tax rates

Tax Mill Rate Commercial Tax Mill Rate. Contact Us Your one-stop connection to DOR.

Most of the surrounding suburbs are around 9-14.

. Bundle of Rights use enjoy control dispose as a way to understand the rights and obligations that are conveyed to others. 372 rows The rate for residential and commercial property is based on the dollar amount per. However some counties charge additional transfer taxes.

This is called the 2½ levy ceiling. Massachusetts voters passed the ballot initiative in 1980. Bostons residential tax rate is 1088 21 cents higher than last year.

FY2021 Commercial Tax Rate. Massachusettss median income is 83915 per year so the median yearly property tax paid by. Motor Vehicle Excise Tax.

MassTaxConnect Log in to file and pay taxes. FY 2022 per 1000 Real Estate Residential 995. Subscribe to Mayor Fullers E-mail.

The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of. Massachusetts property tax rates for 2013 by. For example in Barnstable County the combined state and county excise rate is 285 per 500.

The residential tax rate in. FY2022 Commercial Tax Rate. Thats still down slightly from 1754 in 2018 however.

For example for the owner of a property valued at 250000 a tax rate of 1548 would result in a tax bill of 3870. If youre wondering what. 9 am4 pm Monday through Friday.

Residential Commercial Industrial Personal Property. Note that while the statute provides for a. An office building with a reception foyer wall paintings sculptures furniture can all be assessed and taxed as personal property.

The above slideshow shows the 20 municipalities. Massachusetts Property Taxes These Communities Have The Highest Rates In 2022 Boston Business Journal. 2022 Berkshire County Massachusetts Property Tax Rates.

Excise tax vehicles varies per. Tax Department Call DOR Contact Tax Department at 617 887-6367. Town of Hanover 550 Hanover Street Hanover MA 02339 7818265000 Statement on Community Inclusiveness Website Disclaimer Hours.

Real Estate and Personal Property Tax. Tax amount varies by county. Most surrounding suburbs are between about 9 and 14.

Investing Rental Property Calculator James Baldi Somerset Powerhouse Re Real Estate Investing Rental Property Rental Property Investment Real Estate Rentals. 1995 per thousand of assessed value. A Description of Commercial Transactions.

The Tax Rate is set by the Select Board in the fall of each year. Open Save Print 2022_Property_Tax_Rates 2022 Rates Per 1000 assessed value. Each year local assessors in every city and town in Massachusetts have a constitutional and statutory duty to assess all property at its full and fair cash.

Local Options Adopted by Cities and Towns. An owners property tax is based on the assessment which is the full and fair cash value of the property. Taxes might be in the commercial lease as a pass-through.

Water Sewer Bill. The median property tax in Massachusetts is 104 of a propertys assesed fair market value as property tax per year. The law limits the amount of property taxes a city or town can raise in two ways.

But on the commercial side the median rate in 2020 rose to 1750 from 1737 last year. The residential tax rate in Worcester is 1521. Zip Assessors Phone City Town Residential Commerc.

A commercial tenants furniture fixtures and equipment FFE can be taxed as personal property. Tax bills reflect the tax rate applied to the assessed value of land and buildings on a given property. Fiscal Year 2021 Tax Rates.

372 rows The rate for residential and commercial property is based on the dollar amount per every. Legal requirements for commercial real estate transactions and contracts in Massachusetts. 352 rows Property tax rates are also referred to as property mill rates.

Lexington Town Office Building 1625 Massachusetts Avenue Lexington MA 02420 781-862-0500 Contact the Webmaster About Our Website. Property tax is an assessment on the ownership of real and personal property. Contractual nature of commercial real estate due to size of investments.

Massachusetts has one of the highest average property tax rates in the country with only five states levying higher property taxes. Tax rates are stated as per 1000 of assessed value. The amount raised in property taxes can never be more than 2 ½ percent of the full cash value of all taxable property in a city or town.

2012 per thousand of assessed value. 18 rows The states room occupancy excise tax rate is 57. The people of North Adams have the highest commercial tax rates at 4066 one of 20 communities with commercial tax rates over 30.

Sealer of Weights Measures. Fiscal Year 2022 Tax Rates. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Wendell 2019 tax rate. Massachusetts commercial real estate tax rates Monday April 4 2022 Edit. The basic transfer tax rate in Massachusetts is 228 per 500 of property value.

City of Newton 1000 Commonwealth Ave Newton Centre MA 02459. Real Estate Commercial 2664.

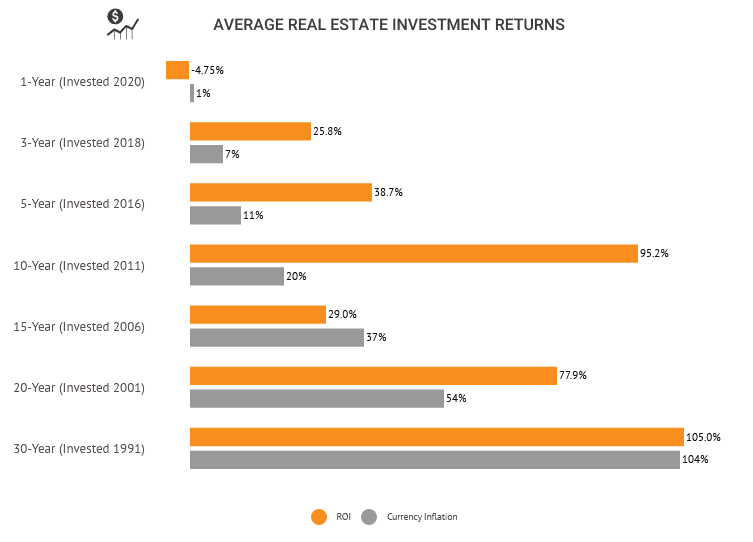

Average Roi Of Real Estate 2022 Historical Analysis Statistics

Capital Gains Tax Rates By State Nas Investment Solutions

Metros Where Homeowners Pay The Lowest And Highest Property Taxes

Capital Gains Tax Rates By State Nas Investment Solutions

Property Tax Information City Of Cambridge Ma

Massachusetts Income Tax H R Block

Marginal Tax Rate Overview How It Works How To Calculate

Massachusetts Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Corporate Tax Rates By State Where To Start A Business

Massachusetts Property Tax Calculator Smartasset

A Breakdown Of 2022 Property Tax By State

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

States With Highest And Lowest Sales Tax Rates

Delaware Property Tax Calculator Smartasset

The Independent Contractor Tax Rate Breaking It Down Benzinga